Quick Links

First, you need to lodge a TAC Claim

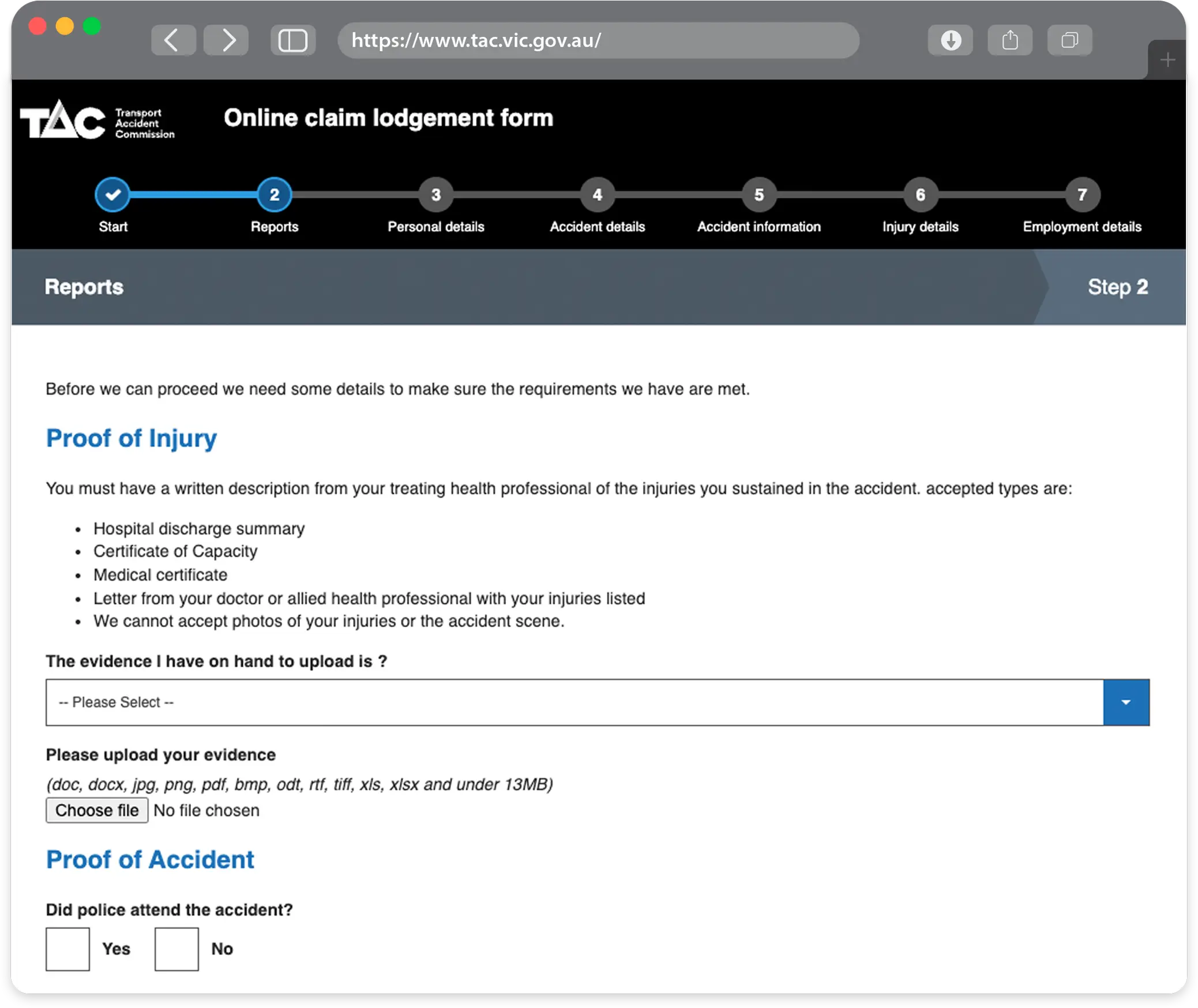

To lodge your claim, contact the TAC on 1300 654 329 or online.

You will need the following information to lodge your claim:

- Police report number (also known as the TIS number)

- Details of the accident

- Contact details for your health care professional/s

- Your employment details

Haven't lodged a claim yet?

Head over to TAC and learn How to Lodge a TAC Claim or call 1300 654 329 for help.

Second, Familiarise Yourself with the TAC Benefits

Income Support

- TAC Loss of Earning Benefits (LOE): If you are unable to work following a transport accident the TAC will pay Loss of Earnings Benefits.

- LOE will generally cover 80% of your pre-accident weekly earnings and are payable for the first 18 months after the accident.

- You can also ask the TAC to make you an Interim Loss of Earnings (LOE) payment for immediate financial support.

- Loss of Wages: If you are the parent of a dependent child with an accepted TAC claim, you can also make a claim for loss of wages.

Medical Expenses

-

You can claim the cost of all reasonable medical expenses related to your transport accident injury from the TAC. Check that your health care professionals are TAC accredited providers.

-

The TAC has a list of treatments and services which can be claimed without prior approval in the first 90 days after the accident. It includes ambulance services, hospital treatment, surgery, medical aids, counselling/psychological treatment, physiotherapy and medication.

Family Support – Travel and Accommodation for Immediate Family Members

- If you are hospitalised as a result of your transport accident injury, and your immediate family members live more than 100kms from the hospital you are staying in, you can ask the TAC to pay the costs of travel and accommodation so your immediate family members can visit.

Death Benefits

-

If a transport accident has contributed to the death of a loved one who was an earner, the dependents of the deceased person can claim benefits.

-

Click here for further information with respect to TAC Death Benefits.

Counselling

- If a loved one has died or suffered a severe injury as a result of a transport accident, the TAC can provide some family counselling support.

- It is important to note that if the accident has caused a mental injury to a loved one left behind, that individual may be able to lodge a separate (their own) TAC claim.

Funeral Expenses

- The reasonable costs of funeral expenses (up to $18,860) can be claimed from the TAC

Impairment Benefit and Common Law Lump Sums

- If your transport accident injury results in a permanent impairment and / or serious injury, you may be entitled to lump sum compensation.

- Impairment benefit and common law claims for damages tend be complex, and we therefore recommend seeking expert legal guidance in this respect.

- It is important to note that impairment determinations and common law claims for damages must be made within six years of the date of the transport accident.

Last, check your Superannuation Entitlements

If you have a superannuation account, you may be entitled to additional support following a transport accident.

Total and Permanent Disability (TPD) Insurance

-

Most superannuation funds offer TPD insurance as part of your superannuation. This can provide a lump sum payout if you’re unable to work due to a serious injury or illness.

-

The eligibility for TPD insurance depends on the terms of your superannuation fund’s policy, but typically, it requires that your injuries prevent you from returning to any form of work.

Accessing Superannuation Due to Injury

- You may be able to access your superannuation early if you are permanently incapacitated due to your injury.

Income Protection through Superannuation

-

Many super funds also offer income protection benefits, which can help replace a portion of your income if you’re temporarily unable to work due to an injury.

-

This can be particularly useful if your TAC claim is still under review or if your income is significantly affected by the accident.

You Could be Eligible for Compensation

At Arnold Dallas McPherson, we have acted for plaintiffs that have lost loved ones or witnessed road trauma, and have assisted them to obtain damages from the Transport Accident Commission. We understand that each and every family and relationship is different and the grief and trauma that you may experience is significant. From our first interview, we support you with advice and guidance as your matter progresses.

Schedule a Free Call

If you find that you could use some compassionate, personal legal guidance to navigate lodging a TAC claim or to access or better understand TAC benefits, the team at Arnold Dallas McPherson can be contacted here. We act on a “no win, no fee” basis, and would be honoured to support you.